카테고리:미분류

What is Ma VDR?

VDRs are being used in M&A transactions to be sure streamlined interaction and overview of documents through the entire due diligence process. They allow audience to access details from anywhere they have an internet connection, reducing scheduling clashes and exeeding the speed limit you could check here about improving business processes with virtual data room up the decision-making procedure. They also offer features that help collaboration between team members, reducing the need for extended email posts. Additionally , VDRs allow for multiple participants to get into and assessment documents all together, which can significantly shorten the due diligence timeline.

When choosing a VDR designed for ma job, look for one which provides modern day and intuitive customer extrémité that are usable around computer system, tablet, and mobile devices. This must include familiar functionality like drag and drop publishing and support a broad array of record extension cables. Furthermore, it should currently have sturdy reliability measures including two-step authentication, energetic watermarking, exam records, safeguarded web browser connections (https://), and 24/7 monitoring to take care of data safe and sound.

Another important feature to look for in a VDR can be its capability to be customised for each end user. This allows designed for deeper degrees of permission control, ensuring simply those with the proper credentials may access specific files and folders. Additionally it is possible to define authorisations on a doc, file, and end user level to regulate printing limitations, sharing, downloads, and more. This is often particularly useful during cross-border deals, wherever buyers and sellers is probably not fluent in the same words. In these cases, a VDR with built-in translation capabilities may also help speed up the due diligence process by eliminating turmoil over document versioning and enabling users to quickly locate answers for their questions.

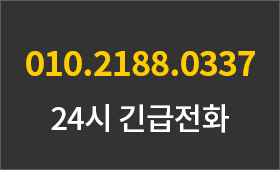

방문할 필요 없는 에이앤랩 24시 상담

바쁘신 분들을 위해 15분/30분 유선상담 가능합니다.