카테고리:미분류

The Benefits of Business Accounts

If you’re running a business, keeping your personal and enterprise finances individual is a key to financial stability. In order to do this kind of, you need a organization account. There are many types of business accounts, ranging from a simple checking and savings account into a money market bank account or qualification of money. Every single account has its own benefits and costs, so discovering the right one to your requirements can help you obtain organized and save money.

Organization accounts are used to track a company’s funds balance, bad debts to lenders and payroll paid to employees. It can be necessary for businesses to keep accurate information in order to make reports that are useful for duty purposes, such as profit and reduction statements, harmony sheets and cash flow assertions.

In addition to providing a place for business keepers to store money and path expenditures, business accounts can also make it better to obtain loans. Creditors commonly view the financial history of a business when deciding whether to extend it credit rating, which is why it’s important for companies to maintain a strong organization banking record.

Having a business account can be beneficial for corporations of all sizes. Having a individual bank account may also help companies stay compliant and allow them to make the most of business-specific solutions, such as accounting and invoicing software integrations, merchant offerings and payroll digesting. Additionally , board software for efficient meetings many banks deliver cost-saving advertisements and regarding business consumers, such as procuring on buys or redeemable rewards details.

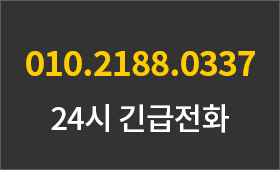

방문할 필요 없는 에이앤랩 24시 상담

바쁘신 분들을 위해 15분/30분 유선상담 가능합니다.