카테고리:미분류

How can Data Room Work?

Investor Data Room is actually a digital system where corporations store data relevant to research. It is often employed for M&A deals, but also for tenders, capital raising and more. It is a secure storage space which you can use by multiple users with granular access permissions and multi-factor go to the website authentication alternatives. There are many cloud solutions that provide data areas, but it is very important to find one that suits your requirements and that offers a cyber-secure environment with templates, ways to deal with files more easily and features like watermarking and end user tracking.

With respect to M&A deals, the Data Bedroom enables potential buyers to view significant volumes of confidential paperwork and perform Q&A rounds in a directed environment. It will help to simplify and speed up due diligence processes, that can otherwise be time eating and expensive for both parties.

Some VCs and founders think that an investor info space might delay decision-making since it provides an easy excuse designed for investors to review the information, instead of just go using a deal which makes sense with regard to their business. Although it’s worth remembering the fact that purpose of a buyer data bedroom is to showcase a startup’s knowledge for any favorable image with potential investors, much less a tool to delay decision-making.

It is best to function back from desired performance and ensure the data you present supports that larger narrative. This will differ by stage and might will include a focus on marketplace trends, regulatory shifts, your team, growth metrics and other convincing “why now” forces.

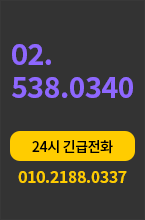

방문할 필요 없는 에이앤랩 24시 상담

바쁘신 분들을 위해 15분/30분 유선상담 가능합니다.