카테고리:미분류

Deciding on a VDR to get Deals Management

Whether they are accustomed to facilitate a merger or acquisition, enable easy due diligence within a fundraise or perhaps help plan for an initial general public offering (IPO), VDRs are valuable tools for a broad variety of business situations. Choosing the right VDR provider to satisfy the specific requires of your organization can considerably expedite package processes, streamline ongoing info management and provides significant savings in storage costs.

To make certain the digital deal room meets your specific needs, select a vendor that offers customization features. For example , various providers deliver work templates that could be adapted in order to meet the requirements of various industries and types of deals. Other folks allow you to install preferred integrations that reinforce efficiency and improve effort.

Another important aspect is security. To prevent breaches and other pricey mistakes, pick a vendor which could limit access to data depending on end user permissions. Additionally, it pays might how the supplier encrypts it is associations and if they have any additional tiers of safeguard like dual-factor authentication.

Mergers and purchases are the most common make use of case for VDRs, but they can also be helpful to companies which have been seeking to increase funds or perhaps expand their very own operations through partnerships. These kind of arrangements typically https://dataroombase.net/ need a high level info sharing that may be difficult to take care of without the help of a virtual repository.

When selecting a VDR for discounts management, be certain that it is compatible with your existing software. Inquire about compatibility with CRM applications and other collaborative software programs to ensure you can continue using your preferred tools. Then, check out the provider’s performance and reliability data to see how much downtime, interruptions and holdups hindrances impediments the services experience.

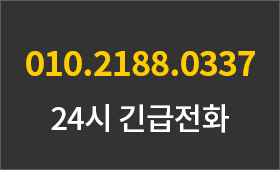

방문할 필요 없는 에이앤랩 24시 상담

바쁘신 분들을 위해 15분/30분 유선상담 가능합니다.